Capital One Binding Arbitration

Consumer credit card agreements which contain customer agreement terms and pricing information.

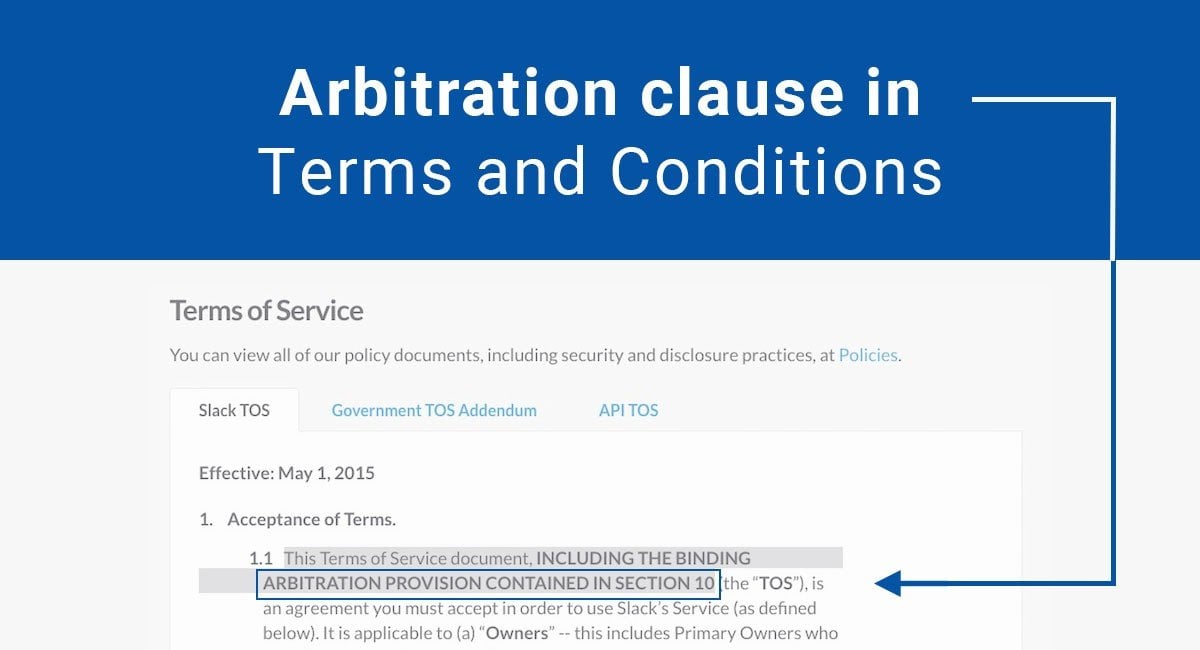

Capital one binding arbitration. You or we may elect arbitration under this arbitration provision with respect to any claim even if the claim is part of a lawsuit brought in court. Indeed binding arbitration effectively eradicates the class action rights that congress established to ensure that businesses had an incentive to treat consumers fairly even in situations where losses suffered by individual consumers would be too small to make individual lawsuits feasible. The pricing information shows a range of terms that includes both mail and online offers for new accounts available under this agreement as of june 30 2020. Capital one financial corp.

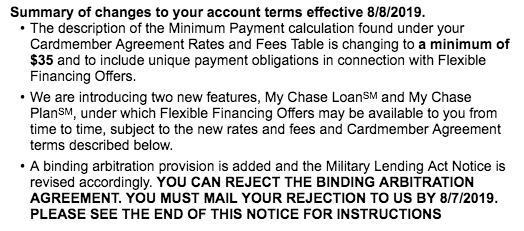

Capital one s cost of suit in this arbitration proceeding. The capital one agreement has the option to resolve any claim by the election of arbitration. In 2009 chase agreed to temporarily drop arbitration clauses from its credit card agreements after a class action lawsuit alleged the bank conspired with capital one bank of america citigroup. Among major card issuers chase capital one and bank of america agreed to give up their credit card arbitration clauses for a period as part of a 2009 settlement of anti trust claims.

Even if you aren t able to cash in on these listed lawsuits your complaint might qualify for binding arbitration with capital one. Capital one further prays for its reasonable attorney s fees and expenses incurred in connection with its counterclaim. Mandatory arbitration clauses are also widespread in contracts for home building nursing homes and other services outside the financial sector. And for such other relief as the arbitrator may deem just and proper.

In december 2009 capital one joined in the retreat and bank of america took its action a step further. See our other capital one article discussing other capital one lawsuits here. Arbitration clauses have become increasingly. Will drop language from credit card contracts requiring customer disputes to be handled through binding arbitration rather than the courts a.

Capital one quietly changed. The new clause stipulates that any dispute between consumers and chase must be resolved by binding arbitration. We help consumers you file claims and get compensated. Electing arbitration is a choice that can be made as a way to resolve a dispute.