Cbre Office Market Report Q2 2020

Downtown vacancy grew for the first time in years now at 3 3 largely attributed to sublease supply soaring as firms look to reduce costs.

Cbre office market report q2 2020. While there has not been a spike in sublease space this quarter sublease activity can be expected to rise in the following quarters. Industrial gva was negative at q1 2020 1 7 y o y average super prime industrial rents were flat. Suburban markets registered a. After 39 consecutive quarters the phoenix office market snapped the streak of positive net absorption in q2 2020 the vacancy rate rose for successive quarters settling at 15 6 for the quarter.

Read our recent report. Atlanta posted 119 097 sq. Availability continued to increase over the period growing by 18 to stand at 16 1m sq ft. Also tokyo all grade rent fell by 0 2 to jpy 23 470 per tsubo the first de.

Currently comprises 87 4 of the ottawa office market. In q2 2020 vacancy remained unchanged from last quarter at 17 6. Under construction space sits at 2 5 million sq. Over the prior quarter to 29 65 per sq.

Under offers fell to 2 4m sq ft below the 10 year average for the first time since 2018. Metro denver posted 84 706 sq. Australian super prime rents average 108 sqm super prime yields remained flat in all markets. Vacant space under 10 000 sq.

Office rent continued its growth 3 y o y into the second quarter boosted primarily by strong u s. Office and industrial sectors continue to show strength while the retail sector has begun to trend down. Dublin office marketview q2 2020. Cbre md property residential rent collection occupancy in dublin june 2020.

Metro vancouver experienced a substantial increase in overall office vacancy to 4 6 70 basis point bps more than in q1 2020. Super prime yields compressed by 5 bps over the previous 12 months land values fell by 0 5 q o q with a. Ireland nursing home market q2 2020. Total vacancy increased 55 bps quarter over quarter to 13 6.

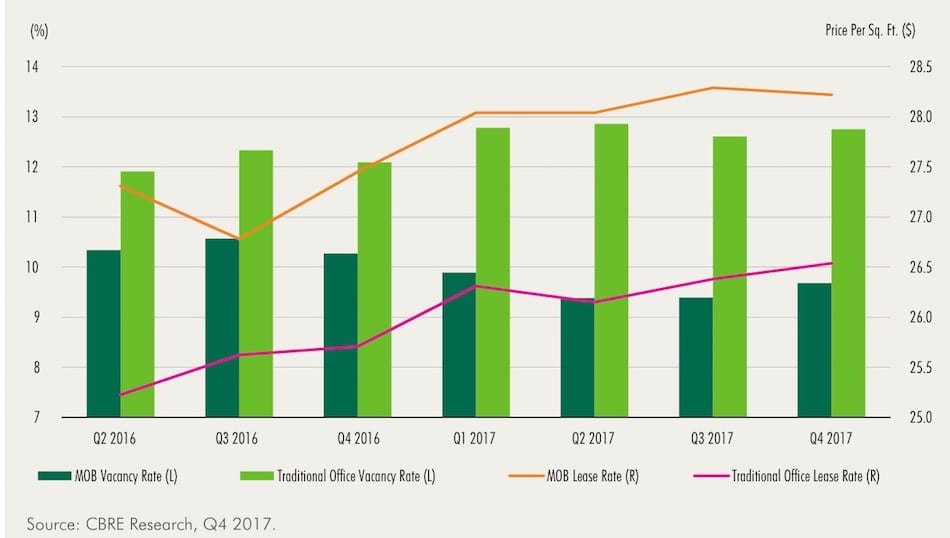

The average direct asking lease rate remained stable at 28 81 per sq. Tokyo rents fell across all grades tokyograde a vacancy rate fell 0 2 points q o q to 0 7 the first decline for two quarters tokyo grade a rents fellby 0 4 q o q to jpy 38 850 per tsubo the first decline since q4 2017. Ft 56 of which is pre leased. Take up in central london declined during q2 to total 1 1m sq ft a decline of 66 from the 10 year quarterly average.

The remaining 12 6 is space in excess of 10 000 sq. Of negative net absorption in q2 2020 the first time in 13 quarters the market has seen negative absorption activity.